How to use Paysera ATMs?

ATM location and working hours

As of writing this, we currently have one ATM ready and fully functioning at the Paysera LT office. It’s located at Pilaitės pr. 16, Vilnius, Lithuania.

The working hours for the ATM at the Paysera LT office are 7:00–22:00 from Monday to Sunday.

Do fees apply for using the Paysera ATM?

Withdrawing cash from the Paysera ATM has a commission fee of 0.35%, however, depositing cash into your account using the ATM is free of charge.

Things to do before using the Paysera ATM

Using the Paysera ATM is very simple and only takes a few minutes, but because it works a bit differently than standard ATMs, we’d like to share a few tips on what to prepare for.

You’ll need the Paysera Super App and an internet connection

Only Paysera clients can use the ATM, therefore you will need to have your phone, Paysera Super App, and of course, an internet connection, with you.

Remember to practice caution

Use a strong password or biometrics for your smartphone and only scan the codes using the Paysera Super App.

There are limits to how much you can deposit/withdraw

Fee for cash-in: free of charge.

Fee for cash-out: 0.35% withdrawal commission fee from the transaction amount.

Single transaction limit: EUR 10,000 (or lower if your account has stricter limits).

Daily limit: EUR 15,000 for deposits and withdrawals.

Weekly limit: EUR 25,000 for deposits, EUR 15,000 for withdrawals.

ATM limits: Up to 200 banknotes and no more than EUR 10,000 per withdrawal.

Check your account limits

For cash withdrawals, it’s important to check your account limits to make sure that you can withdraw the amount you want.

Remember: if you need to change the limits, it should be done 12 hours before you need to withdraw the money, as that’s how long it takes for the changes to happen due to security reasons. However, if you need it done quicker, you can contact our client support and they will speed up the process for you.

How to change your account limits?

We’ve prepared detailed instructions on how to change your account limits in our other blog post and the video below. Choose whichever format you prefer! Either way, it will only take a few minutes to change your account limits.

How to deposit money into the Paysera ATM?

Open the app and tap the scan icon in the top right;

Select My QR code;

Scan the QR code at the ATM scanner to cash in;

Select the amount and confirm.

How to withdraw money from the Paysera ATM?

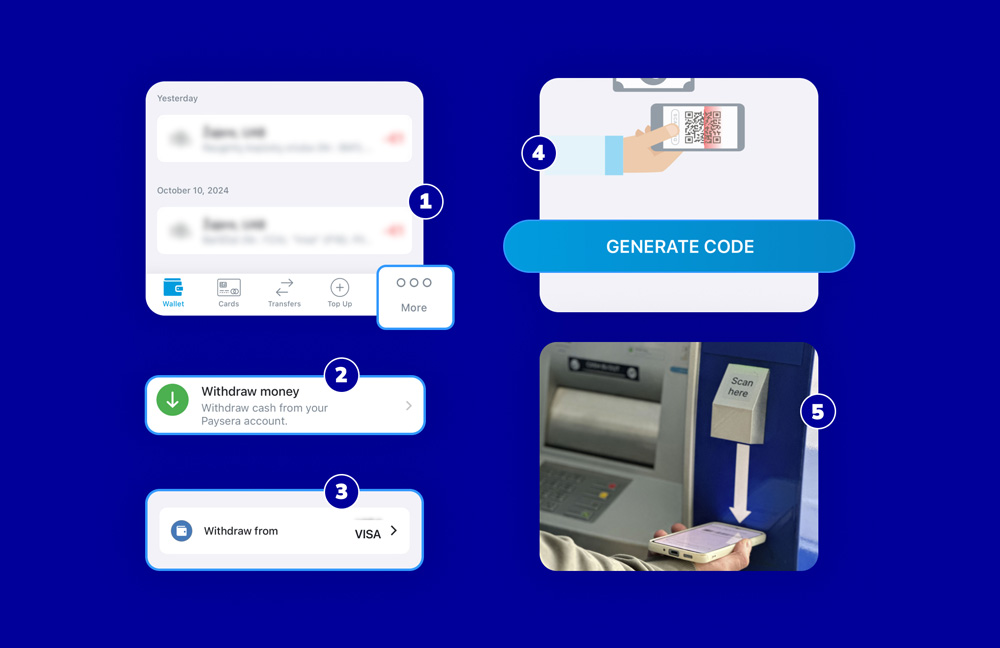

Open the app and tap More;

Select Withdraw Money > Barcode;

Select the account you want to withdraw money from;

Tap Generate code;

Scan the generated barcode at the ATM.

Where to get help?

If you’re facing difficulties at the ATM and you’re not sure how to proceed with something specific that you have in mind, there are a couple of ways we can help you.

If you’re using the ATM during our client support centre's working hours, you can visit next door and our consultants will be happy to assist you.

If you’re using the ATM after our client support centre's working hours, call us at +370 5 2071558 and we will help you over the phone.